Category: Give

The Healing Power of Art

Planned Giving

Grateful Patients

Memorial & Tribute

Charitable IRA Gifts

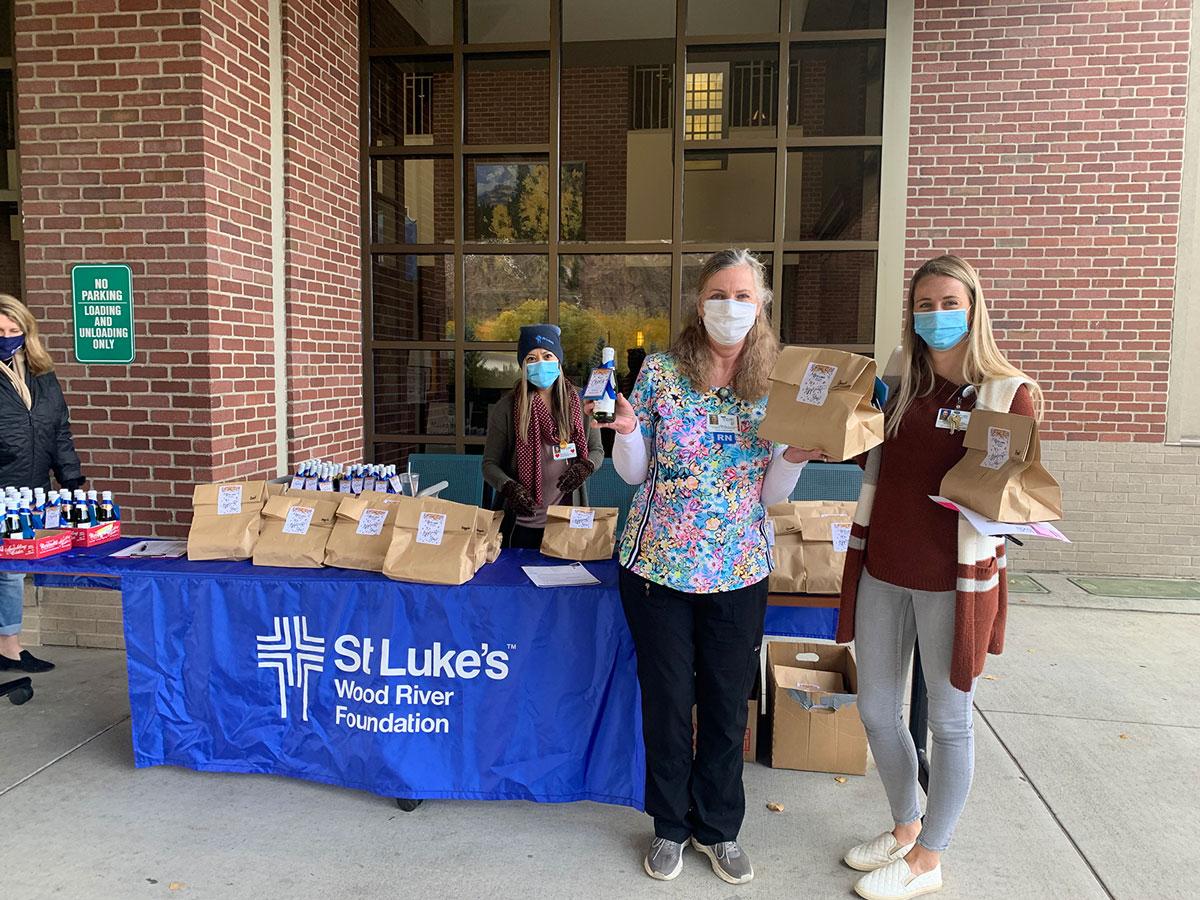

Friends of the Hospital

Donations of Securities

The St. Luke’s Wood River Foundation welcomes gifts of securities, including stocks or mutual funds that have appreciated in value. Gifts of publicly traded securities provide a double tax benefit for donors. Donors avoid a capital gains tax on appreciated securities and receive a charitable income tax deduction for the full fair market value of the securities.

According to IRS guidelines, the date and value of the gift are determined by the date on which the St. Luke’s Wood River Foundation takes control of the securities. For securities held by brokerage houses, a donor must simply provide his or her broker with instructions to make the transfer to the St. Luke’s Wood River Foundation account.